On this page

- Departments (1)

-

Text (7)

-

Untitled Article

-

. j}l.\iM«i*-liV rrfttV Vf : >*i*ti-r I ^ilmlllutu (itlU llMHUIIlfci CUIl. ¦ —

-

Untitled Article

-

Untitled Article

-

Untitled Article

-

Untitled Article

-

Untitled Article

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software. The text has not been manually corrected and should not be relied on to be an accurate representation of the item.

-

-

Transcript

-

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software. The text has not been manually corrected and should not be relied on to be an accurate representation of the item.

Additionally, when viewing full transcripts, extracted text may not be in the same order as the original document.

Untitled Article

THE PUTTJEE OF THE REVENUES OF-INDIA .:

Fkom time to time of late years the condition of Indian finance , with its frequent deficiencies and rare surpluses * has been the subject of discussion , and occasionally even of late , uneasiness has been expressed that the revenues of India , apart from political disturbances , would be found sufficient to meet the railway guarantees , or even the yearly charge for the dividends of the , East India proprietors . Looking at the slow progress made by the revenues of India , -which it is considered only grow by the annexation of provinces , and bear with them with an increase of charges tending to augment the deficit , there are those who look rather gloomily on the future of Indian finance . There are three aspects under which Indian finance may be regarded . First , in reference to ordinary technical considerations- ; with regard to the mode in which revenue can be . nursed by reduction . and commutation of taxes ; with a view to the relief of the population , and the gradual growth of revenue . There is , next , the consideration how far the judicious outlay of capital on rail- ! ways , canals of irrigation , and"bther public works , and in the encouragement of English settlers , will tend to increase the permanent resources of the country . There is , however * a further subject for consideration , and which it may be said has met with , very little attention , except a reference to it in one publication , and a casual mention before the Statistical Society , and that is the influence which in India will be exerted on prices by the certain progress of the country .

Having regard to the peculiar nature of the gross revenues of India , derived as they are to so great an extent from charges on land , which though , according to eminent authorities , they are governed by the theory of rent , but which in practice are found to constitute , in too many cases , a prohibiting taxation , grinding down the tenantry to pauperism , and enforced by the most odious oppressions—having regard to the dependence of the Indian Exchequer on land revenues , on which remissions are rather to be looked for than augmentations ¦—it is very difficult for the ordinary application of financial expedients to be attended with any great results . There are , besides , other revenues of objectionable basis and precarious duration , the opium revenue and the salt-tax , and all the shifting , and changing , and financing will only succeed in finding substitutes to make good ~ the deficiency which the suppression of these may involve . But of a gross revenue of 80 , 000 , 000 / ., , 17 , QO 0 , PQQJ . are raised from the land revenue , 5 , 000 , 000 / . from the opium revenue , 2 , 600 , 000 / . from the salt-tax , that is to Bay , 25 , 000 , 000 / . from heads of taxution which do not admit of increase . The customs duties only produce 2 , 000 , 000 ? ., the property and income-tax have been abolished , the excise duties arc trifling , and the stamp duties only amount to about half a million . For the collection of those revenues no less than six million *) are disbursed , exclusive of civil , judicial , police , ' and military charges , which are strictly caused by the peculiar character of the land tenures of the country , and without reckoning tho exactions inflicted on the -popultttion * by-the-corrupt'native > oflicialsj- « -l ? or-anything- > that is known at present the roal charge of the revenue department is much more likely to be eight millions than six millions , and may very possibly bo ten millions . What the 17 , 000 , 000 / . of land revenue really coats the tenants 'and peasantry of India * " coin and in kind , in suffering and privation , it Is quite impossible to toll . The able administrators of India have felt called upon to oxort themselves to obtain remissions for the tax papers , who , while seemingly assessed at low rates , are found to bo in a condition of actual beggary . There is room , undoubtedly , for great improvement in

Indian financial administration , Which will be effecte d when the European staff and population are largely increased , but a great dependence for the maintenance of the revenue on a footing of stability must be placed on the results of a very extensive outlay on public works . Remissions of taxation will do small good for the ryots of India in proportion to what will' be effected by increasing the produce of their lands by the application of water , and by improving the money price of the produce bv creating means of conveyance to market . It is well for collectors to say that their districts want no roads , for that the country is a natural road for six months Of the year , but the real test is the cost of the brinjarry , moved by a miserable bullock-team , and conveying half a ton four or six miles per day , at prices higher than some of the worst parts of Ireland . There are whole regions of India where it is a week ' s work , in the favourT able season , to convey produce fifty miles . Under such circumstances much of the produce niust rot , and there is a positive discouragement to production . Even coffee , grown by the English settlers , cannot be got to the coast at the right season for shipment .

When the railway system , branch roads , and steamtrains come into play , the certain results will be to obflbin better prices for the produce of the country , to stimulate production , and to stimulate consumption . All articles of local consumption will have , a wider area of market , and all exportable articles will have means of reaching the shi pping ports . If we consider how many of the producing countries of India are a thousand miles from their seaports , we must be convinced how great is the influence exercised on the pr ice of conimodities by the cost of transport , and how important it is , with a view to production , to provide facilities of transport . This provision , as yet oh a limited scale , but certain to be extended , will , as we have saUV dp more & > r the real relief of the ryot than all that the new assessment in Bombay and Madras has yet effected , and without loss to the public service . As the matter has hitherto been considered , it has been held certain , that at each survey and reassessment further remissions must take place , in order to place the cultivator in a condition to obtain a decent livelihood , but where new cominunica ^ tions have been opened , and new markets created , the necessity for . these remissions will cease . Thus , in the long run , the irand-tax or land-rent , whatever people like to call it , will be preserved at something like its nominal amount . We may go further , for looking at the condition of the zemindar of Bengal , as Mr . Hendriks has done in his admirable memoir on the Statistics of Indian Revenue and Taxation , we may consider how far the zemindar should be made to bear the brunt of taxation by means of property and income-tax . Taking the taxable income of this class in the zemindar districts at ten millions , three per cent , will give 300 , 000 / ., and five per cent . 500 , 000 / ., and should there be another commotion , our own war rate of ten per cent , would give 1 , 000 , 000 / . from classes who can well afford it ;

The resources of India in the future arc good for maintaining the hind-tax , and for compensating the opium revenue and the salt-tax by an increase of customs , stamps , and property-tax . While the nominal rates of these are raised there will be a real relief by an increased rate of production throughout the country , and by the certain result of a rise in prices . This is a result which has taken place in every part of Europe by the improvement and extension of markets , and notably as a consequence of tho railway system . Thus , throughout the greater part of Europe , wages are advancing and the prices of many commodities ; and to the careful observer the same influence is to be recognised in India , In Assanrij Tennaserim , Pegu , Darjeeling , the Neilgherries , the coffee districts , there is a relative scarcity of labour and a considerable rise in wages , and although at the present moment the Madras and other emigrant coolies partially supply the labour market , yet the new settlements cannot go on demanding and absorbing labour without affecting the populous and depressed-districts . This result , considered local and temporary , is beginning to attract tho notice of the settler and the journalist ; and on the railways , and in districts such as Dacca an advanced rate of wages—it may be said a double rate of wages—has been established , which is by some set down to the advanced price of provisions—one whichwill not recede—^ bcing only another expression of the same operation . As prices rise to the level of those districts in which there is the greatest enterprise and the greatest demand for labour , tho proportional incidence of taxation will be less felt , and at the same time the money rate and money return of taxation will bo increased , because prices will bo affected . Thus tho weight of tho debt » will-beTle 8 B * fflt r the'C 03 ts-of-coHeotion-win « bo . diminiBhed ,-publle credit will bo greater , the military establishment less extensive , but in all departments of the Government service a higher rate of pay will prevail correspondent to tho alteration of prices . Thus in the future of Indian finance wo must look forward to a groat and salutary influence by the vast expansion of the resources of the country , and tho establishment of a rate of prices more favourable to tho cultivator and producer in India , and thereby more favourable to the manufacturing interests in this country .

. J}L.\Im«I*-Liv Rrfttv Vf : ≫*I*Ti-R I ^Ilmlllutu (Itlu Llmhuiilfci Cuil. ¦ —

ftiernntfile anfe Cnmnimial .

Untitled Article

forttess life in the lowland garrisons of Indi ^ would be in a more hopeful and cheerful state whe n on service . They would have the hope before them of reioininff their families at the end of a campaign , they would have a hoine . tp go ta in the hills it sick or wounded ; the unmarried soldiers , ill or wounded , would have brothers , sisters , relatives , and . friends in the hills to whom to resort ; and the feelings of home would be enjoyed in a home near at hand without too much yearning for the old hoine beyond the wide sea . . . , The proposition of General Tremenheere includes so much that it truly sound and practical in a military point of view , so much that is truly advantageous in a national point of view , and it would achieve such great moral results , that we do smcerely hope it may meet with careful and favourable consideration .

Untitled Article

THE LEABEB . [ No . 441 , September 4 , 1858 . ' < : \ 912 ... ¦ ¦•• ' . . . . ' . — ¦ ¦ . . ' -, —— - — - ¦¦ ¦ ¦ - ¦• - ^ - ¦ ¦¦ - - ¦ —— ¦ ¦ ¦ - ¦ ¦— —— ¦ - ¦¦ - ¦ - , ¦

Untitled Article

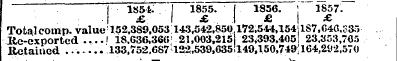

1854 . I 1855 . I 1856 . ' 1857 . £ ' \ £ . . ] £ | £ Tofcalcomp . value 152 , 389 , 053 143 , 542 , 850 . 172 , 514 , 154 ! 1 S 7 , C 4 ( 5 , S 35 Re-exported ! i 8 . G 36 , 30 ( 5 ; 21 , 003 , 215 23 * 393 . 405 ! 23 . , 765 Retained ...... 133 , 752 , 687 122 , 539 , 635 ! l 49 , l 50 , 749 ilC 4 , 2 H 21570 Exports . . * . Dec . val . Brit . ) 97 , 134 , 726 95 . . 0 S 5 115 , 826 , 948 122 , 155 , 237 produce ..... ) i . 1 1 ¦ For . and Col . do . 18 , 636 , 366 21 , 003 . 215 23 , 393 . 405 2 . $ , 35 ;? , 7 G 5 Total ' 115 , 821 , 092 : 116 . 691 , 300 139 , 220 . 353 145 , 509 , 002 Aggregate ofV retained iin- / 249 , 573 . 779 239 , 230 , 935 283 , 371 , 102 309 , 801 , 572 . pQ [* CS cLllCL CX * I . . . ¦ . ¦ ' ports . . J ¦ ¦ Excessi : val . of > 17 , 931 , 595 6 , 848 , 335 9 . . 18 , 753 , 578 ¦ imp . over cxp . j- ¦ ¦ . Equiv . to p . cent . : lo ' o 5 7 13 o

Untitled Article

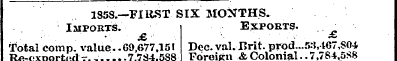

185 S .-FIll . ST SIX MONTHS . Imports . Exports . ^ Total corap . value . . 69 , 677 . 15 ! Dec . val . ¦ Brit . prod ... M , t 67 , S 04 Re-exported r .- 7 . 784 . 5 S 8 Foreign & Colonial .. 7 , 784 . 5 S 8 Retaiued ...=--. 61 , 892 , 5 G 3 Total exports .... Cl , ' 2 Ci , a'J 2 Aggregate retained imports and exports £ 123 154 , » 55 Excess \ 'aluo of imports over exports ... .. £ < i 3 ^ . 1 7 *

Untitled Article

From these figures we learn that the yearly average value of our imports and exports combined in the last four years has been , exclusive of bullion , 271 millions . This is an enormous amount of property . It is all circulating and floating , as contradistinguished from land , which is emphatically fixed or ' real property , and every farthing of it is the fruit of industry . On the average of the four years , the value of the imports , it will be noticed , was above that of the exports 13 millions , equivalent to 10 per cent ., an indication , but not a correct measure , of the great amount of profit derived from trade in these years . Nor is the relation altered by -including the precious hietals . In the beginning of 1854 , the Bank had 10 , 000 , 000 / . biillipn ; at present it has 17 , 000 , 000 / . In all other countries similar phenomena occur , and the greater value of imports I than of cxporls in each and every country is a mcu- I sure of the pecuniary advantages of trade to tlic I world . I

It will bo seen , however , that m tlic urst nait oi the present year the excess of imports is exceed- I ingly small . Tho figures are not , indeed , strictly I correct . Tho official account of the value of the I foreign and colonial products exported is not yet sun- I p lied , and the figures given in the table under this I head are assumed , ana arc one-third of the total I valuepf the foreign and colonial , prqdupo exported I in 1857 . As tlio quantities generally of imports I re-exported in tho first six mouths of 1 S 5 S equal H the quantities re-exported in 1857 , the assumptiou i of only pne-third fulls below the actual value of tho J foreign produce exported . In fnct , we believe that m tho valuo of tho exports in- the first half of this m year has exceeded the value of tho imports , and I ho M approximation to faots shows an alteration in ou . ' m trade whioli is undoubtedly greater and more signi- m fieaufc tlian is expressed hi tho table . Tho average Jm of tho total imports for tho four years was 101 mil- m lions , and of the exports of British produce 107 . w -millions ^ AB-lG 4-is ^ o-107-BO ^ 3 » 09-to ^ i 5 J - % v . h aLU < Ul—_^< tho value of British produoo exported in tho six i months is 53 millions , or 8 millions above tho pro- | portion of tho four years , clearly demonstrating the | change in tho relative value of imports to exports | in 1 , 8 . 58 . It differs from tho four previous years , in J whioji tho valuo of tho imports was greater thim < that of tho exports . , 1 At tho same time , tho real course of trade is not J muoh altered . Similar articles in not very disaimiliu 'Jg quantities iiro imported ami exported in 1858 us M

Untitled Article

THE VALUE OF OUR TRADE . The recent publication of the computed value of our imports aiid the declared value of our exports for the first six months of 1858 is a favourable occasion for . stating the actual amount of our trade . In 1854 the value of our imports was first computed ; till then , notwithstanding our multiplied statistics , there was only an old official scale of assumed prices , which gave a clue to the quantities but not to the real value of our imports . Over the increasing value of our exports there was , on the old theory that nations get rich by what they send away , continual exultation , and no notice was taken of the increasing value of what came in , which aloue could add to our wealth . The following table gives an account of the computed value of our imports and the declared value of our exports for the last four and a half years : — VALUE OF OUR TRADE . Imports .

-

-

Citation

-

Leader (1850-1860), Sept. 4, 1858, page 912, in the Nineteenth-Century Serials Edition (2008; 2018) ncse-os.kdl.kcl.ac.uk/periodicals/l/issues/vm2-ncseproduct2258/page/24/

-